Kaia Portal Mission Epoch #1 Incentive Design

Missions are designed to boost liquidity and user engagement within the Kaia ecosystem. We’re allocating up to 50 million KAIA tokens, alongside participating projects which will also be allocating their tokens. When you successfully complete Missions, you will earn points that can be converted into vested KAIA tokens and project tokens once the Epoch ends.

In Epoch 1, the Missions will revolve around providing liquidity to Kaia DeFi protocols, and the rewards will be:

Kaia points

Points from participating projects

D2I program rewards

Yield from DeFi protocols

New applications and DeFi use cases built on Kaia will expand the range of available assets and support increased volume, resulting in higher fees for liquidity providers and boosting ecosystem trading activity. This will create a flywheel effect, where increased activity and liquidity enhance the overall ecosystem.

Maximum Transparency

While many point systems are opaque about their rewards calculations, Kaia Portal Missions are designed to be maximally transparent, in everything from campaign duration to point calculation formulas as we believe that Kaia users deserve nothing less.

Campaign Duration

The Missions will officially begin on September 26th, and as of now, we have Missions planned for the following three months. During this period, additional airdrop opportunities, new participating projects, and asset boosts will be introduced with each Epoch.

Early Adopters

If you participate in the Missions between August 29th and September 26th — even if you deposit just $1 into any DeFi protocol listed in the Mission tab — the corresponding wallet will qualify for the Early Adopter boost which will add a 1.2x bonus multiplier to all points earned thereafter.

Rewards

Kaia Rewards

Up to 20 million KAIA will be rewarded to general participants based on milestones. Wallets that participated in the FGP-23 voting in the existing Finschia ecosystem will receive up to 30 million KAIA. This reward pool is separate from the general participants’ pool and is exclusively for wallets that voted in FGP-23. Users with long-term on-chain contributions in the Finschia ecosystem can receive a weighted reward of 10 million KAIA by participating in the Kaia Portal Missions, based on their contributions.

25M KAIA (10M for general participants / 15M for FGP-23 participants) allocated for the points airdrop

12.5M KAIA (5M additional KAIA for general participants / 7.5M KAIA for FGP-23 participants) unlocked at $100M TVL

12.5M KAIA (5M additional KAIA for general participants / 7.5M KAIA for FGP-23 participants) unlocked at $150M TVL

*The pool for FGP-23 participants does not overlap with the general participant pool.

Vesting

Tokens converted at the end of the campaign will be distributed over six months. When the campaign ends and a user claims point conversion (Kaia Points to Kaia Tokens), the Kaia Tokens will have a 6-month vesting period.

In addition, through the D2I program, participants can receive immediate Kaia rewards and project points without vesting.

*Vesting: Vesting is a process where you earn the right to receive full ownership of certain assets (like stocks or tokens) over time. It prevents you from getting all the assets at once, ensuring you stay committed to the project or job.

*Vesting Over 6 Months: If you have 100 tokens with a 6-month linear vesting period, you don’t get all 100 tokens immediately. Instead, you get them gradually, say around 15~20% of tokens each month for 6 months, until you have the full amount by the end of the period.

Partner Project Rewards

All participants will receive points from each partner in their respective Portal Mission.The criteria for points provision vary by partner, and details will be updated soon.

All projects participating in Kaia Portal Missions are required to have been audited by professional auditors and verified protocols, so you can safely participate with confidence.

Participating Projects

*Alphabetical Order

Avalon (Defi Lending)

Backed by Matrixport Ventures, SNZ Holding, Spark Digital Capital, Summer Capital and more

Audited by Salus

Avalon Labs stands as the leading Bitcoin-focused lending ecosystem, uniquely positioned at the intersection of DeFi, CeDeFi, and RWA (Real-World Asset) lending. Avalon Labs pioneers the integration of overcollateralized Bitcoin-backed loans, offering seamless access to fiat liquidity using Bitcoin as collateral. Focused on unlocking Bitcoin’s full potential, Avalon Labs is not only transforming how digital assets are leveraged in DeFi but also spearheading innovation in CeDeFi to meet institutional needs — particularly Bitcoin-backed loans for fiat. Recently they achieved over $1B in TVL . Through its dynamic platform, Avalon Labs is shaping the future of Bitcoin finance, where decentralized and centralized models converge to create more efficient, scalable, and secure lending solutions.

Capybara (DEX)

Built by the Wombat team (backed by Binance Labs, Animoca, Shima, and Jump Crypto)

Audited by Hacken, Peckshield, and Zokyo

Capybara, launched using the technology of the multi-chain stable swap Wombat, introduces a new DEX on the Kaia chain that integrates a gamified point system, a launchpad, and an airdrop playground. Notably, the Capybara launchpad will be the first on the Kaia chain, acting as a direct bridge between the Kaia chain and global users. Capybara innovates the coverage ratio-based stable swap mechanism, removing scalability barriers, allowing participants in the Kaia ecosystem to utilize capital without the risk of impermanent loss. It also minimizes slippage, supports single-token LP tokens, and offers an ideal DEX for lending protocols and trading platforms, all supported by a user-friendly UX/UI. The official launch, including the $CAPY token, is expected to bring vitality to the Kaia ecosystem.

Dragonswap (DEX)

Built by the Dragonswap team, audited by KALOS

Dragonswap is currently the leading DEX in the Kaia ecosystem, offering both V2 and V3 liquidity provision features through an open-source protocol. It aims to redefine a sustainable DEX environment, focusing on community engagement with rich liquidity, high trading volume, and openness. The Dragonswap team is comprised of various ecosystem experts.

Sustainability: Dragonswap currently has no native token. It aims to create a sustainable DeFi ecosystem by encouraging participation in the Kaia ecosystem through KAIA incentives and a points system.

Rich Liquidity: Dragonswap secured at least $4 million in initial strategic liquidity and currently holds approximately $9 million in liquidity.

Efficiency: With ample liquidity, Dragonswap provides fast transaction speeds and low fees through its V3 liquidity provision service.

Community Initiatives: Dragonswap participates in the Kaia Foundation’s D2I program, dedicated to supporting the Kaia community and its users.

Kaiaswap (DEX)

Built by the iZUMi Finance team (backed by Mirana, HASHKEY, IOSG, BIXIN Ventures, and more)

Audited by Certik and BlockSec

Kaiaswap, the first native DLAMM (Discretized-Liquidity-AMM) DEX on the Kaia chain, is based on the innovative technology of iZUMi Finance, which focuses on leading the decentralized finance sector with a strong emphasis on technology and user experience. By concentrating liquidity at specific price points, this AMM model achieves high capital efficiency. This approach aims to provide transparency, security, and an efficient on-chain experience within the sustainable and verified Kaia chain ecosystem. KaiaSwap will offer safer and more accessible DEX services on the high-performance Kaia chain, combining iZUMi’s unique DEX-as-a-Service solution with DLAMM, account abstraction, and multi-signature features, all with low gas fees.

*Participating projects may be updated continuously.

Incentive Design

Point Definition

A point is non-formally defined as:

Kaia point = Liquidity pool (DEX, Lending) multiplier * Asset boosting multiplier * other boosting multiplier * user’s liquidity contribution (user’s TVL) * Time + Referral points

Project point = Depending on the project’s point system policy

Providing liquidity to each project will allow users to earn Kaia points and project points simultaneously (additionally, referral points also).

More formally, Kaia point is defined as:

Where

Due to computational limits, time will be computed hourly.

*Referees’ referral point is not counted in Pr,p′ to prevent second-order referral effects.

Multiplier Explanation

*More project pools, assets, and other multipliers will be added during the campaign. *Each multiplier number can be adjusted during the campaign.

Liquidity pool multipliers

Different risk levels associated with each DeFi’s characteristics are accounted for in the reward multipliers. For example, a USDT-USDC pair pool in a Decentralized Exchange (DEX) has very low volatility due to the stability of the assets, thus lower risk and lower reward multipliers. Conversely, a KAIA-USDT pool has higher risk due to KAIA’s price volatility, warranting higher reward multipliers. These multipliers are set based on thorough research of existing Kaia and other chains’ DeFi APR data but may be adjusted for optimization during the campaign.

Notes

If a DEX uses a model where users select a price range for liquidity provision (e.g., Kaiaswap), users will only receive point rewards when supplying liquidity within the current price range.

When depositing assets into a DEX pool, you may be exposed to impermanent loss if the prices of the assets fluctuate significantly. For an explanation of impermanent loss, please refer to this link.

For DEXs that use a model where users select a price range to provide liquidity (e.g., Kaiaswap), users receive more point rewards when they supply liquidity closer to the current price range.

*At the time of the launch on August 29th, only the liquidity pools based on stablecoins from the list below will be supported initially. The other pools listed below will be supported gradually.

Project

Liquidity Pools (Continuously updated)

Supported Asset

Multiplier

Avalon

USDT (Portal from ETH)

USDT (Portal from ETH)

Low

Avalon

USDC (Portal from ETH)

USDC (Portal from ETH)

Low

Avalon

stKAIA pool

stKAIA pool

Low

Capybara

Main Pool (Wormhole)

USDT (portal from ETH) + ETH (portal from ETH) + WKAIA

High

Capybara

Stable Pool (Wormhole)

USDT (portal from ETH) + USDC (portal from ETH)

Low

Capybara

Main Pool (Stargate)

USDT (Stargate) + ETH (Stargate) + WKAIA

High

Capybara

LST Pool

KAIA + KAIA Liquid Staking (npKAIA added)

Low

Capybara

Stable Pool (Stargate)

USDT (Stargate) + USDC (Stargate)

Low

Capybara

KRWO Pool

USDT (portal from ETH) + KRWO + KAIA

High

Dragonswap

USDT/WKAIA LP

USDT (portal from ETH) + WKAIA

High

Dragonswap

USDT/WETH LP

USDT (portal from ETH) + WETH (portal from ETH)

High

Dragonswap

USDT/USDC LP

USDT (portal from ETH) + USDC (portal from ETH)

Low

Dragonswap

KAIA/stKAIA

KAIA + stKAIA

Low

Dragonswap

KAIA/KRWO

KAIA + KRWO

High

Dragonswap

USDT(Portal)/KRWO

USDT (portal from ETH) + KRWO

Low

Dragonswap

USDT(Stargate)/USDC(Stargate)

USDT (Stargate) + USDC (Stargate)

Low

Dragonswap

KAIA/USDT(Stargate)

USDT (Stargate) + KAIA

High

Kaiaswap

USDC.e/WKAIA

USDC (Stargate) + WKAIA

High

Kaiaswap

USDT.e/USDC.e

USDT (Stargate) + USDC (Stargate)

Low

Kaiaswap

USDC/USDC.e

USDC (portal from ETH) + USDC (Stargate)

Low

Kaiaswap

USDT/WKAIA

USDT (portal from ETH) + WKAIA

High

Supported Assets and Multipliers

Initially, the following assets will be supported, with more to be added later:

Name

Symbol

Point Multiplier*

Contract Address

Bridge / asset link

Kaiascan Link

Wrapped Kaia(WKAIA)

WKAIA

1

0x19aac5f612f524b754ca7e7c41cbfa2e981a4432

N/A (Automatically converted when providing KAIA liquidity on DEX, etc.)

Lair Staked KAIA

stKAIA

0.9

0x42952b873ed6f7f0a7e4992e2a9818e3a9001995

Wrapped Governance Council KAIA

wGCKAIA

0.9

0xa9999999c3d05fb75ce7230e0d22f5625527d583

sKAIA

SKAIA

0.9

0xa323d7386b671e8799dca3582d6658fdcdcd940a

npKAIA

npKAIA

0.9

0xb0bb95ac3195a266ab924596ba32c2a10e245a95

USDC(Stargate, hydra)

USDC.e

1.66

0xe2053bcf56d2030d2470fb454574237cf9ee3d4b

USDT(Stargate, hydra)

USDT

1.66

0x9025095263d1e548dc890a7589a4c78038ac40ab

WETH(Stargate, hydra)

WETH

1

0x55acee547df909cf844e32dd66ee55a6f81dc71b

USDC(Portal from ETH)

USDC

1.66

0x608792deb376cce1c9fa4d0e6b7b44f507cffa6a

*It must be sent from the Ethereum chain.

USDT(Portal from ETH)

USDT

1.66

0x5c13e303a62fc5dedf5b52d66873f2e59fedadc2

*It must be sent from the Ethereum chain.

WETH(Portal from ETH)

WETH

1

0x98a8345bb9d3dda9d808ca1c9142a28f6b0430e1

*It must be sent from the Ethereum chain.

KRWO (KRWO)

KRWO

1.66

0x7fc692699f2216647a0e06225d8bdf8cdee40e7f

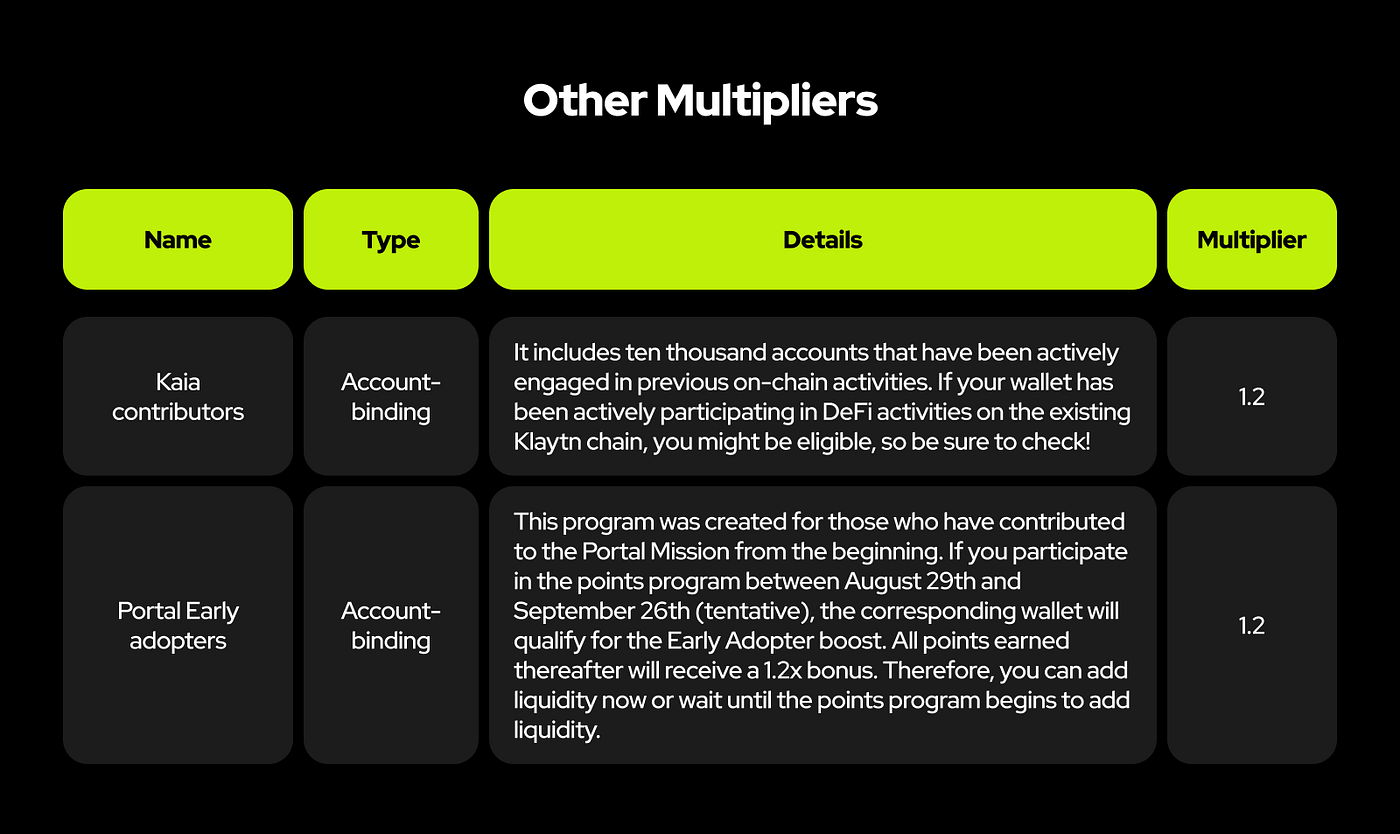

Other Multipliers

Various multipliers beyond the liquidity pool and assets will be added during the campaign.

Referral Points

To encourage participation with friends, we have also created referral points. Person A, who invited person B, will receive an additional 10% of the points accumulated by person B. Referral points are only credited for people directly invited by the user. For example, if B, who was invited by A, invites a new person C, a portion of C’s points will not be additionally credited to A.

Notice

If points are earned through methods other than consistently providing liquidity, and those methods are not in line with the intended use of the point system, your points may be subject to adjustment. Additionally, any points accumulated incorrectly due to temporary system errors might also be revised later.

Last updated

Was this helpful?